Fixed Acquirer Network Fee Details

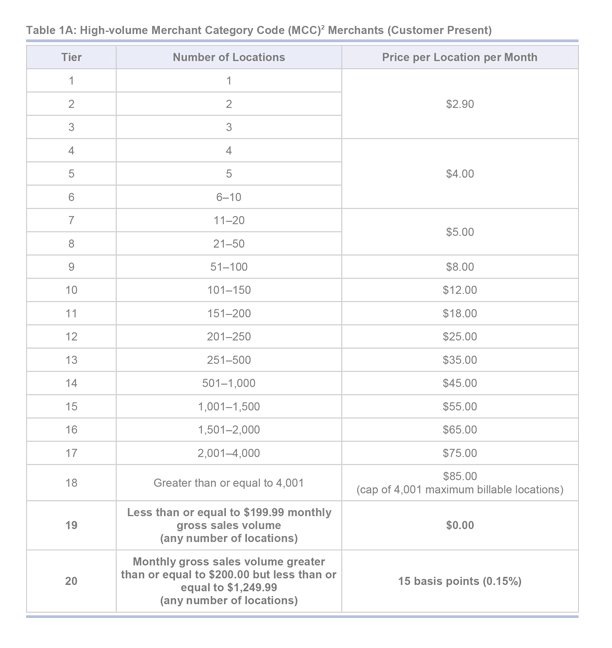

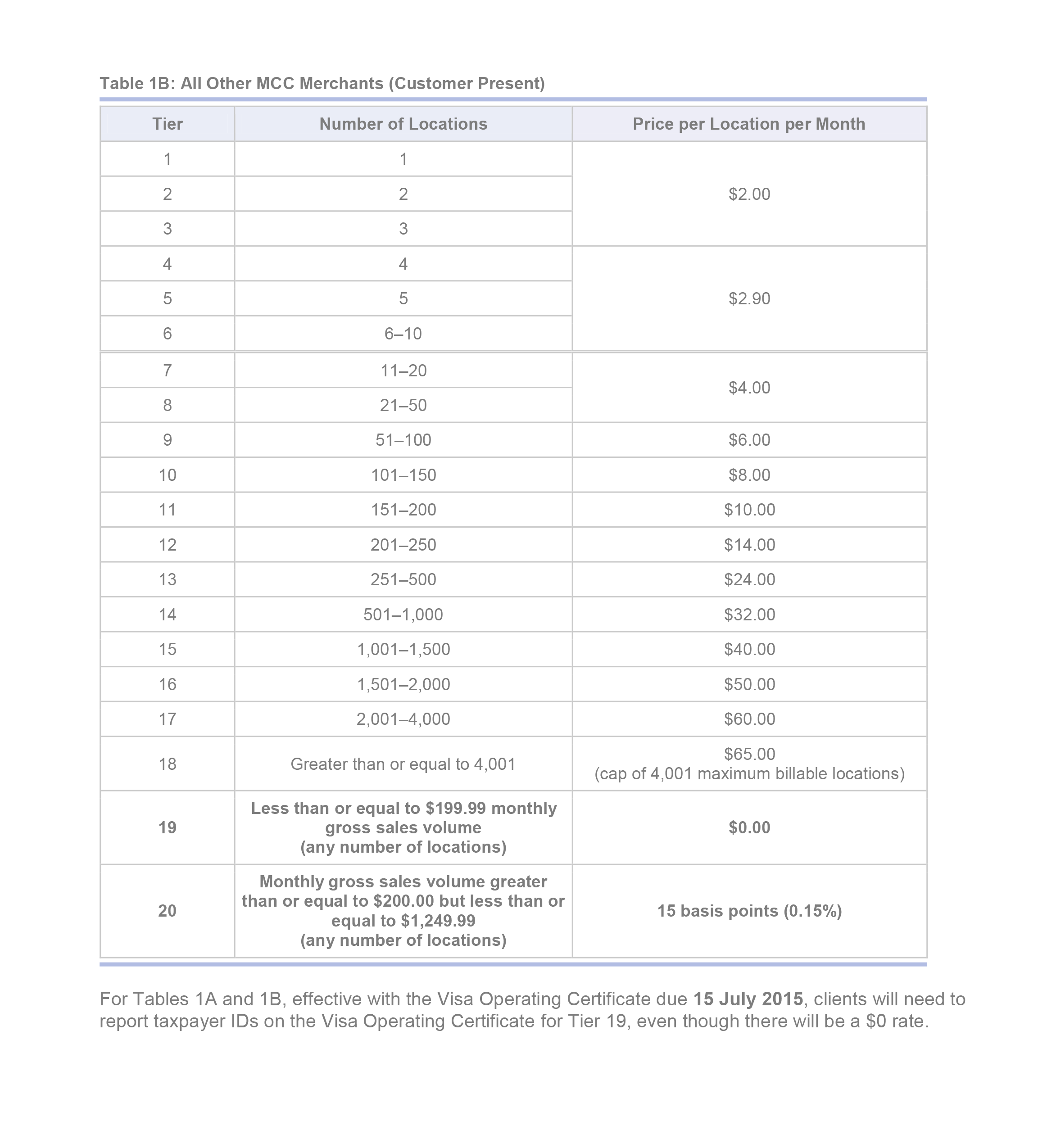

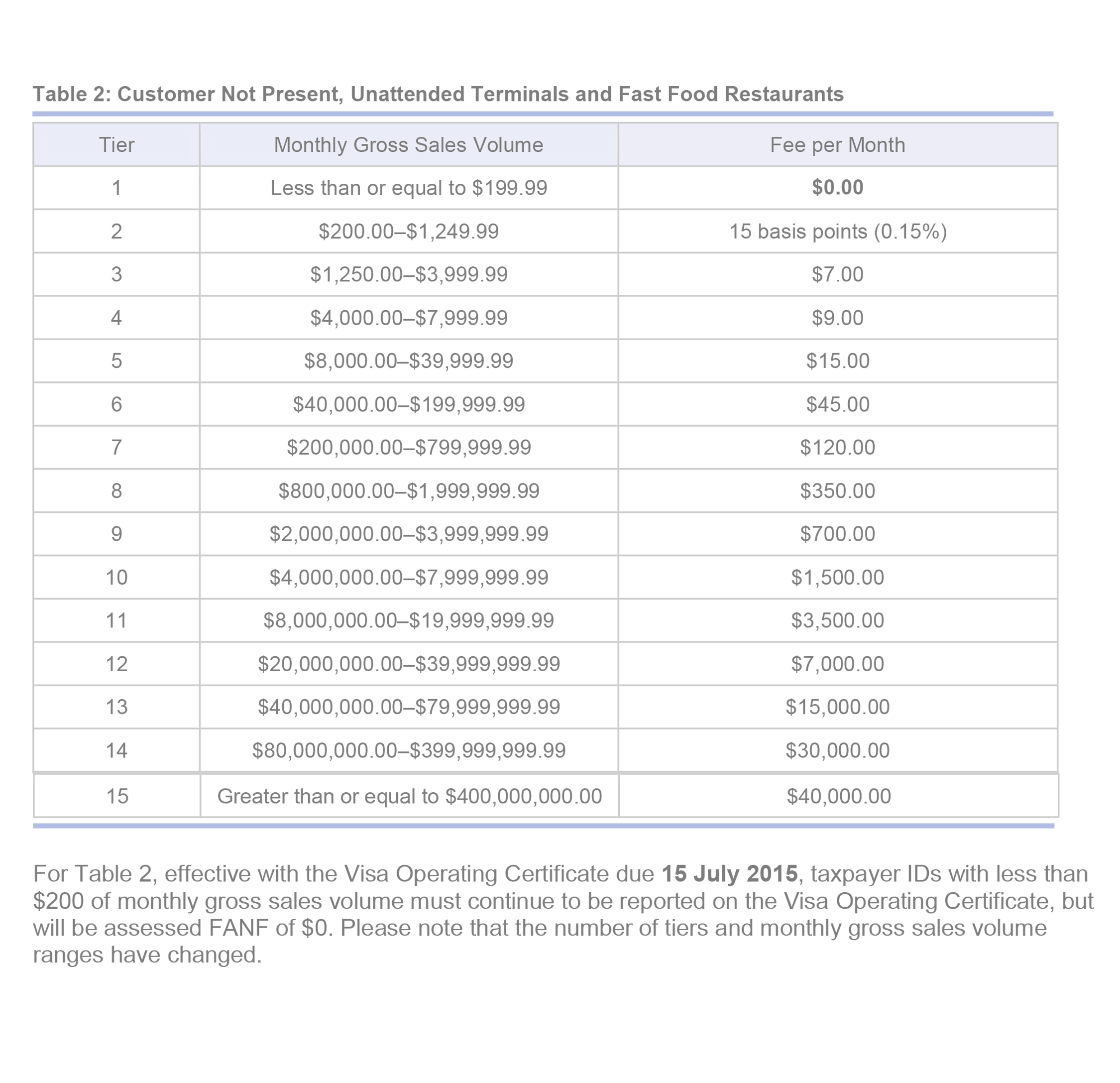

The U.S. Fixed Acquirer Network Fee is a monthly fixed fee that will be assessed per merchant Tax Payer ID and will be based on the number of merchant locations, Merchant Category Code (MCC), and monthly total gross merchant sales volume originating from Visa Credit, Visa Debit and Visa Prepaid cards associated with each Taxpayer ID.

- Card Present merchants, with the exception of Fast Food Restaurants (5814), will be assessed the FNF based on merchant Taxpayer ID on a per-location rate basis (See Tables 1A and 1B rate charts below).

- Customer Not Present Volume (defined as originating from transactions with an ECI/MOTO indicator of 1-9), merchant aggregators and Fast Food Restaurants (MCC5814) will be assessed the FNF based on gross merchant sales volume originating from any Visa-branded card (See Table 2 rate charts below).